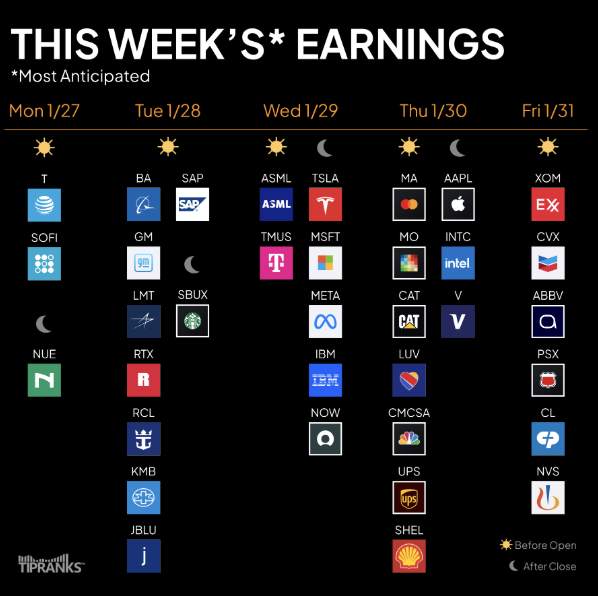

The week of January 27, 2025, is pivotal for the financial markets, with several major companies reporting their earnings. Below is an overview of key companies that have reported their earnings this morning and those scheduled to report later this week, along with analyses of their potential impacts on stock prices.

Companies Reporting Earnings This Morning:

1. AT&T Inc. (T):

- Earnings Overview: AT&T reported adjusted earnings per share (EPS) of $0.54, matching the previous year’s figure, on revenue of $32.3 billion, surpassing analysts’ expectations of $0.50 EPS on $32 billion in revenue.

- Impact on Stock Price: Following the earnings announcement, AT&T’s stock surged by approximately 5.9%. The positive market reaction is attributed to strong subscriber growth and better-than-expected financial performance.

2. SoFi Technologies Inc. (SOFI):

• Earnings Overview: SoFi reported fourth-quarter EPS of $0.29, with a 19% revenue increase to $734 million. However, the company provided softer future earnings guidance, projecting first-quarter EPS of $0.03 and full-year 2025 EPS between $0.25 and $0.27, below analysts’ expectations.

• Impact on Stock Price: The stock declined by 10% post-announcement, as investors reacted to the conservative guidance despite strong current performance.

Companies Reporting Earnings Later This Week:

1. Apple Inc. (AAPL):

• Scheduled Report Date: January 30, 2025.

• Significance: As a leading technology company, Apple’s earnings provide insights into consumer demand for electronics and services.

• Factors to Watch: Investors will focus on iPhone sales, growth in services revenue, and performance in emerging markets.

2. Microsoft Corporation (MSFT):

• Scheduled Report Date: January 29, 2025.

• Significance: Microsoft’s results are indicative of enterprise software demand and cloud computing trends.

• Factors to Watch: Key areas include Azure cloud services growth, developments in artificial intelligence initiatives, and performance in the gaming sector.

3. Tesla Inc. (TSLA):

• Scheduled Report Date: January 29, 2025.

• Significance: Tesla’s earnings shed light on the electric vehicle market and renewable energy adoption.

• Factors to Watch: Investors will monitor vehicle delivery numbers, profit margins, and updates on new product developments.

4. General Motors Company (GM):

• Scheduled Report Date: January 28, 2025.

• Significance: GM’s performance offers insights into the traditional automotive industry’s health and its transition to electric vehicles.

• Factors to Watch: Focus areas include vehicle sales figures, progress in electric vehicle initiatives, and supply chain management.

5. Meta Platforms Inc. (META):

• Scheduled Report Date: January 30, 2025.

• Significance: As a major player in social media and digital advertising, Meta’s earnings reflect trends in online engagement and advertising spending.

• Factors to Watch: Key metrics include user growth across platforms, advertising revenue, and developments in virtual reality ventures.

6. Exxon Mobil Corporation (XOM):

• Scheduled Report Date: January 31, 2025.

• Significance: Exxon’s results provide a window into the energy sector’s performance and global oil demand.

• Factors to Watch: Investors will look at oil and gas production levels, refining margins, and capital expenditures.

In summary, this week’s earnings reports are crucial for assessing the health of various sectors, including technology, automotive, and energy. Investors should pay close attention to these announcements, as they will influence market sentiment and stock valuations.

TipRanks Earnings Calendar.